Generally, a Holdco itself does not produce goods nor provide services, but exists mainly to hold shares of another company or to hold investments.

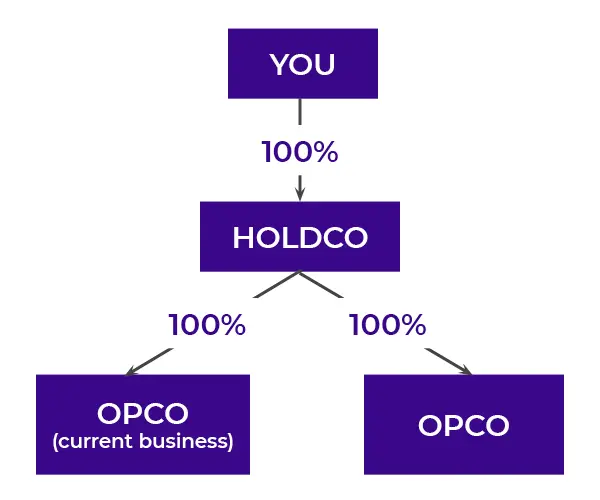

Sometimes, a Holdco is a corporation that holds the shares of another company that carries on an operating business. This Holdco is a company that is interposed between the owner and the active business, which may allow profits to be flowed up to, and retained in, the Holdco.

In other cases, a Holdco may be used to own investments, be they a portfolio of marketable securities or some rental properties, rather than owning the investments in your personal name.

Benefits of a Holdco

There are a number of reasons why you might consider using a Holdco to own operating company (“Opco”) shares. These benefits would not be typically available through a one-corporation structure.

1. Asset Protection

As a business owner, the legal structure by which you hold certain assets (e.g. land, building, vehicles) and conduct business operations can be an important planning consideration. Even in the best run businesses, unforeseen circumstances can arise: markets can dry up, costs can increase or competing products or vendors can challenge your market share. Setting up a Holdco for certain assets, such as investments, generally means they are not accessible by creditors of the Opco.

In some circumstances, it may be beneficial to hold real estate used in a business in a separate Holdco, and have the Opco pay fair market value rent to the Holdco.

It’s preferable to implement these plans while the business is solvent and there are no pending claims against it. Once a claim has been filed, it may not be possible to move assets out of the operating entity. Consult with a lawyer on asset protection planning.

2. Hold the HoldCo (Oct. 2019)

You may be able to move retained earnings from the Opco by paying tax-free inter-corporate dividends to the Holdco. In some cases, recently enacted tax rules may apply to treat intercorporate dividends paid in excess of retained earnings as a capital gain, so be sure to consult your tax advisor as to the amount of dividends that may safely be paid. The Holdco can then reinvest these dividends in a variety of investments, if desired, including a diversified portfolio of marketable securities.

Should the Opco ever require funds, the Holdco can provide a secured loan by lending the money back to the Opco. Legal documentation should be put in place that permits the Holdco to seize Opco assets to make good on any loans in default. This should give the Holdco lending the money a priority claim to the assets of the Opco, ahead of certain other creditors in the case of Opco’s bankruptcy.

Note that there are detailed rules, as well as exceptions, when it comes to the prioritization of security interests, including “super-priority” interests for unpaid wages and income and sales taxes payable. Again, an insolvency lawyer should be consulted before engaging in any type of asset protection strategy involving a Holdco.

3. Flexibility in Timing

A Holdco can provide flexibility in the timing of dividends paid to shareholders. In some cases, there are multiple shareholders of the Opco, and the shareholders may not always agree on when they want to receive income personally, and thus be responsible to pay personal tax on the dividend income received. For example, one shareholder may not need their dividends to cover personal living expenses in the calendar year they are declared while another shareholder may have a need for current cashflow provided by dividends.

The reason that some shareholders may wish to defer receiving payments from the corporation when they do not otherwise need the funds personally is that by leaving the funds in a corporation, only the corporate tax is paid while the personal tax on the dividend can be deferred, indefinitely, until the dividend is paid out to the shareholder. Since the corporate tax on the business income is generally lower than the personal tax rate, if dividends are deferred to a future year, part of the ultimate tax on the income is deferred until the dividend is paid.

In the interim, these additional funds are available to be invested inside the corporation. If shares in the Opco are held through each shareholder’s individual holding company, it may be possible to pay tax-free intercorporate dividends to each Holdco. The shareholders can then decide when to extract the funds from their personal holding companies, at which time they will pay personal tax. Otherwise, funds can be invested within the holding companies, and part of the overall tax can be deferred.

A lawyer must be consulted to make sure the share subscription is properly executed and sufficient funds are paid for the shares. A tax advisor should also be consulted before paying intercorporate dividends to make sure they are not re-characterized for tax purposes as a capital gain, as discussed above.

4. U.S. Estate Taxes

If U.S. estate taxes are of concern, then holding U.S. investments such as common shares of U.S. corporations in a Holdco may be considered. U.S. estate tax should not apply where U.S. investments are held in a Canadian Holdco, rather than directly by the shareholder. Be sure to speak with a knowledgeable cross border tax advisor before embarking on this strategy.

Main Advantages to a Holdco/Opco strategy

- Creditor Protection – HoldCo can be used to shelter any excess income or assets from the OpCo’s creditors.

- Tax Free Dividends and Efficient Reinvestment – Dividends can be paid from an OpCo to a HoldCo on a tax-free basis in most situations. This allows you to use this money to make investments through the HoldCo without first paying the dividend tax.

- Lifetime Capital Gains Exemption – Holdco’s get to take advantage of the lifetime capital gains exemption which currently is Having a HoldCo may allow you to take advantage of the $866,912 Lifetime Capital Gains Exemption.

- Income Splitting – While income splitting has become more difficult to the TOSI rules, careful structuring and planning may allow for a HoldCo to split income amongst various people, including family members, so as to reduce overall tax liability which can then be invested in a tax efficient manner.

- Jurisdiction – You may be able to locate your HoldCo in a province that has a lower corporate tax rate thereby saving even more tax than if funds were held solely in the jurisdiction that the OpCo was incorporated.

Ready to start an incorporation?

Fill out our BC Incorporation Form to get started.